| |

| |

|

|

|

|

Measuring Brand Value |

|

| Key Questions |

Given a set of tangible product features, what is the price premium a consumer is willing to pay for my brand compared to a competitor' brand or an unbranded product? |

|

What are the intangible product attributes and image features that lead to consumer willingness to pay a premium price? |

|

Who are the customers that are willing to pay that premium for my brand? |

|

Who are the customers that are willing to pay that premium for the competitive brand? |

|

How do they differ from each other? |

|

With regard to these attributes and features, how does my brand compare to the competition? |

|

How does the equity of my brand(s) develop over time? |

|

Which activities will increase (or decrease) my brand's equity? |

|

What activities of my competitors will cause/have caused their brand equity to increase or decrease? |

|

Does the equity of my brand carry over to other products and services? If yes, what are these products and services to which equity of my brand extends? |

|

What is the added value of combining brands into "superbrands"? |

|

How do consumers in my product category segment? What is the proportion of "brand loyal", "price sensitive", or "feature sensitive" consumers? |

| How is the approach different? |

Our brand value model is not just a composite measure of various factors thought to be related to brand value and brand equity. In other words, we don't simply measure "brand image", "brand awareness", "brand loyalty", and other concepts and combine them into a score we then call "brand value". Instead, we measure brand value as an independent entity and then decompose that measure into its key drivers. The advantage of this approach is that it does not make any assumptions about the degree to which each factor contributes to brand value. Different markets, products and product categories will result in different brand value profiles. |

| Conceptual Introduction |

The measurement and management of brand value has become a major issue for marketers and marketing researchers over the last several years. The concept of brand value and brand equity goes well beyond the legal concept of a trademark or the accounting concept of goodwill. Brand equity encompasses a gestalt of intrinsic values, or equities, that adds to the tangible, measurable benefits delivered by a particular product or service. These intrinsic equities may include such things as the image imparted to the purchaser, advertising quality, advertising quantity, trust, long term reputation for reliability, customer support, social responsibility, and so forth. |

|

As an example, two "unbranded" credit cards may deliver the exact same set of features in terms of fees structures, APR, acceptance, credit lines, etc. As long as these two products remain unbranded, they will be undifferentiated and therefore equivalent to the user/purchaser. But, if we label one of those cards "American Express" and the other "Acme" , most users/purchasers will attribute additional, intrinsic, value to the American Express product. The two branded credit cards are no longer undifferentiated. The same concept applies to service industries such as telecommunications. |

|

The key challenges in Brand Value/Brand Equity measurement are now to:

- measure the importance of "brand" in the consumers product selection process

- to dissect that measure of "brand" and determine its key contributing components

|

|

Consumers see a particular brand name as a contract. A brand's name may reduce consumers' sense of uncertainty, allowing them to purchase uncertainty reduction, or trust, thus improving their sense of value. Promotion of a brand can address either price/costs, tangible brand attributes or intrinsic brand attributes (equities). Brand equity is communicated using consistent visual cues and consistent messages, allowing the consumer to quickly and efficiently distinguish between brands and their intrinsic product attributes. As a purchaser considers the tangible product features in concert with brand equity (and price), they arrive at a set of products in a category which they will consider for purchase (i.e. their consideration set). Thus, a brand's equity is dependent on effective communications to the target market(s) and brand equity can be improved to some extent with improved effectiveness of communications. |

|

A brand's equity therefore becomes part of the tradeoff a consumer considers as they first select their consideration set, then decide which product or service to purchase. That is, purchasers actively trade off both the perceived tangible benefits and the perceived intrinsic benefits delivered by products in their consideration set, against price, to arrive at their value hierarchy, and ultimately their purchase decision. |

|

Brands that have high perceived value are always included in a purchaser's consideration set. If a brand's combined tangible and intrinsic equities are consistently higher than any other brand in the category, that brand will have the highest customer loyalty in terms of purchase, repurchase, and recommendation. Competing brands can only improve their loyalty against the brand equity leader by lowering price in the short term, improving their product's tangible features in the mid term, or improving their brand's intrinsic benefits, or equity, in the long term. |

| Measurement Issues |

The challenge to both marketers and marketing researchers is determining how we measure and manage the intrinsic value of a brand (its equity) and how do we tie that value and our attempts to improve value to customer loyalty. |

|

Recent literature addressing brand equity indicates that there are several different approaches to measurement. Brand equity can be addressed at either the corporate level or the category level and can also be addressed using internal data or external data. At the corporate level, brand equity can be assessed using internal financial data from the firm's accounting system, or it can be assessed using comparative financial performance data from similar firms (i.e. external). At the category level, a firm can address brand equity using unit profit margins in comparison to unit marketing costs, and in comparison to the costs of other products in the category. Alternatively, the firm can use consumer surveys to measure the perceived value of the product/brand compared to other products/brands in a category. |

|

These alternatives are shown in the following table

| |

Internal |

External |

| Corporate Level |

P & L statements

Balance Sheets |

Financial Comparatives

Industry norms |

Category Level |

Unit margins

Unit profitability |

Customer Surveys |

|

|

We advocate using customer surveys at the category level to measure brand value and brand equity, then using that information to aggregate brand equities to the corporate level. |

| SDR's Brand Value Model |

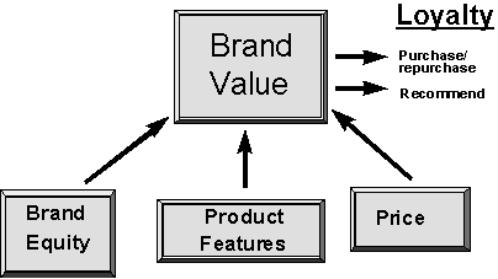

Buyers who are considering a purchase scan their service options and develop a consideration set. Within the consideration set, they develop a hierarchy of brands based on their assessment of Price, Product or Service Features, and Brand Name. Typically, they choose the brand at the top of their hierarchy, if available. If a brand is consistently at the top of their hierarchy, the buyer will be loyal to that brand. |

|

We believe consumers try to optimize value within a product or service category. Consumers therefore assign utilities (worth) to price, each relevant performance attribute, and brand equity. Consumers then trade off performance attributes and brand equity against price in order to optimize value. The relationships between the individual values of price, performance attributes and brand equity is summative and equal to total brand value. |

|

The values each respondent places on price, performance attributes, and brand equity define their value equation for a product or service category. We can derive these values at the respondent level using modified trade-off exercises. |

|

A key advantage of the Brand Value Model is that it allows the calculation of utilities and importances at the individual consumer level. This acknowledges the highly individual nature of the evaluation of products and services in many categories. Furthermore, it permits an exploration of value structures across existing consumer segments or the development of new segments based on the components of the value equation. |

|

We believe the total value of a brand in a particular product/service category is composed of three parts. One part is due to the physical and readily identifiable (and replicable) features of the brand that delivers specific, tangible benefits to the purchaser, thus impacting purchase choice. We call these the tangible product features. The second part is due to some perceived intrinsic value associated with the brand name due to such things as the image transferred to the purchaser, trust, longevity in the marketplace, social responsibility, consistent performance, and so forth (i.e. the intangibles), impacting purchase choice. We refer to this as the brand's equity. The third component is the price/cost of the product. Thus, the total value (or utility) of a product or service is a function of 1.) its physical, tangible, deliverable features, 2.) its brand equity, and 3.) its price. |

|

In addition, we believe that a brand's value is directly related to customer loyalty. That is, if a particular brand maintains a significantly higher perception of value to a consumer than any other brand in the category, that consumer will consistently purchase that brand and consistently recommend that brand to others. Conversely, as brands in a category become less differentiated in terms of both tangible and intrinsic features, price becomes the major differentiator of value, and thus, there is little loyalty.

|

|

We observe that people tend to trade off price against the combined bundle of tangible product features and brand equity in order to optimize total utility or total value. |

|

We also note that the intrinsic part of a brand's value, brand equity, may be positive or negative, meaning that a brand name can be used to increase overall utility of a choice, or may detract from the overall utility of a choice. Said differently, a positive brand equity allows a marketer to charge a premium in the market place over the value of the bundle of tangible features alone, or over the value of an unbranded product/service. And, some branded names in a particular category could have such a negative value among some purchasers such that the brand's equity could be below that of an unbranded, or base line, product/service. |

|

The estimate of brand equity is relative to the other brands in the measured competitive set. Therefore, to obtain an estimate of absolute brand equity we often recommend that the study include either an unbranded product, a store brand, or a dummy brand name, whichever is most appropriate for the category. This provides the base price point for estimating brand equity in terms of its absolute dollar value. |

| What does this measure yield? |

Immediately, you will learn the value of your brand name compared to both branded and unbranded competitive products. This measure is attractive to the marketing practitioner, because it restates the abstract construct of brand equity in dollar values. Brand equity is measured in the context of tangible product features and price. Thus, our model provides you with a detailed understanding of the relative importance of brand equity, compared to tangible product features and price. We can monitor a brand's equity over time through a series of market studies. This allows us to observe the effects of changes in the marketing mix on brand equity and "share of preference". |

|

We have developed a computer-driven market simulator that allows you to manipulate any combination of price, product features and brand equity and observe changes in share of preference for the total market or defined market segments. With this simulator you are able to vary features of your own products and those of your competitors. |

|

The advantages of this modeling approach are:

- The model is not dependent on internal financial data.

- It is relatively fast and easy to execute using proven research methods.

- It can be executed at any time in the business cycle. That is, it is not dependent on internal cyclical accounting changes.

- It takes into account all major relevant brands in a defined product/service category.

- It measures brand equity relative to other current and potential brands in the category, including unbranded items when they exist in the category.

- It recognizes that value of any one brand's equity can be defeated in the marketplace by competitor pricing strategies, at least in the short run.

- It allows the firm to assess price elasticity and cross elasticities of their own brands and competitor brands in a category.

- Results can be projected to estimate the total value of a brand name under alternative sales projections. Thus, this modeling approach can be used to evaluate the total dollar value of a brand name for purposes of evaluation and acquisition.

|

| All consumers are not created equal... |

One of the core concepts of the Brand Value Model is the notion that individual consumers have different perceptions of value in any given product or service category. Thus, it is in most cases necessary to study the differences in those value perceptions and build a comprehensive market segmentation on the basis of those value perceptions. |

|

Since the Brand Value Model is based on trade-off models that measure brand value at the individual respondent level, it is particularly well suited for market segmentation efforts. Resulting segments are then incorporated in the market simulation model. This allows the user to model and simulate the effects of service changes and value perceptions for very targeted slices of the total market. This is particularly helpful when the marketing effort at hand is focused on the development of new service programs, advertising campaigns or other communications efforts. |

|

|

|

|

|

|